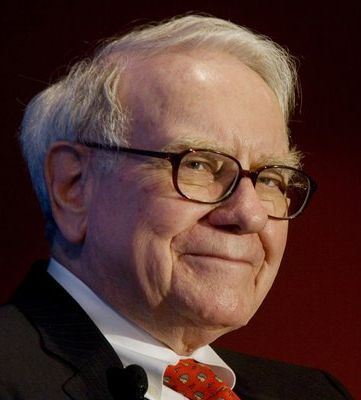

Warren Buffett known under the nickname "The Oracle from Omaha" — one of the most known investors of the world. He was born in Omaha, the State of Nebraska, on August 30, 1930. His father Howard Buffett was the successful exchange trader and the congressman. It is quite natural to assume that Buffett will be engaged throughout family traditions in business and investments. However by and large it is impossible to tell that this "secret" made Buffett successful. Certainly, work of the father since early years created interest to financial operations, the markets, to the exchange at Warren Buffett.

Young Buffett made the first transaction at the age of six years. In shop of the grandfather it bought on pocket money six cans of "Coca-Cola" on 25 cents piece and sold them on 50 cents to members of the family.

In 11 years Warren Buffett, seeing an example of the father, I decided to try exchange speculation. Having united with elder sister Doris, and having borrowed money at the father, he took three shares of Cities Service for $38. Soon their price fell to $27, and then rose to $40. On this mark Warren sold actions with the purpose to record profit and earned $5 minus the commission. However only in some days the price of Cities Service exceeded $200 for an action. Buffett still remembers that mistake. It acquired a lesson: is useless to compete with the exchange in ability to predict a situation. Since then Warren Buffett considers that life taught him the main principle of investment – "the patience is rewarded".

In 13 years young Warren Buffett undertook delivery of the Washington Post newspaper and earned on it $175 a month. Inspired with success, it surprised all relatives, having declared that if by 30 years doesn't become the millionaire, will jump off from a roof of the highest building in Omaha. Buffett safely overcame a 30-year mark, and earned the first million when to it was 31 years.

In 15 years Buffett with the friend enclosed $25 in purchase of the game device which friends put in a hairdressing salon, and in the next months built "network" of game devices from 3 pieces in different places of the city.

In 1947 Warren Buffett graduated from Wilson's Washington school, and before it as before any young man there was a question: and that further; whether it is worth spending the time for training when at this time it is possible to earn money. By 17 years Buffett's condition reached five thousand dollars which he earned in the same way – carried mail and constantly traded. Admiration causes that fact that if to transfer this amount of a modern equivalent – 42 thousand 610 dollars and 81 cents, becomes clear that already then Warren Buffett resolved to become a millionaire.

After return to Omaha, Buffett continued to work in broker firm of the father. In 1954 Benjamin Graham at last offered Buffett a position of the analyst in the company in which Warren worked two years. For this term he became skilled in operations on the stock exchange and felt ready to the beginning of big business.

So, in 1956 Buffett founded the Buffett Associates company. Warren Buffett did the most successful purchases in time or right after large exchange crises when the majority of investors avoided the market.

All consider as its outstanding ability, first of all, supersuccessful investments. The person simply owns art at the right time to buy that is necessary and it is necessary to sell as. He takes the shares provided with serious assets, counting on that sooner or later the market will appreciate these papers. Its main strategy purchase of the underestimated companies is. Also Buffett is known for the largest transactions on absorption and merges, and also transactions on purchase of insurance companies. In the 90th Buffett rescued Salomon Brothers investment bank.

Despite inquisitive and resourceful mind, in a life Warren Buffett is faithful to the habits. The wealth didn't affect almost its settled tastes. With special pleasure it uses things which are made at the enterprises which actions made for it considerable profit. List of such things and enterprises the quite big: "Washington Post" newspaper — profit 1 billion dollars, "Coca-Cola" — 10 billion dollars, the Gillette razor — 5 billion dollars, "American Express" credit card — 4 billion dollars.

One of the basic rules which Warren Buffett strictly adheres, is never to have affairs with what he doesn't know or doesn't understand. It served in due time as refusal in an investment of money in Microsoft corporation. All the life Buffett played a role of the naive gawk from the province, considering that thus attracts to itself money.

But all this is no more, than carefully thought over role for importunate public for which Buffett here in a row puts on many years on himself a mask of the loser gawk. Except a communication manner, this image is maintained by the suits which have got out of fashion and the old Honda car, worth about 700 dollars. But this external impression is very deceptive.

Warren Buffett considers that the main secret of successful investment — to choose good actions in due time and to hold them until these actions remain good.

|